On June 11, 2021, Governor DeSantis signed Senate Bill 76, which created Fla. Stat. §627.70152. This anti-policyholder statute was passed in an alleged effort to reduce insurance claim litigation.

The new statute, entitled “Suits arising under a property insurance policy,” went into effect on July 1, 2021. The new law “applies exclusively to all suits not brought by an assignee arising under a residential or commercial insurance policy.” As a condition precedent to filing a suit under a property insurance policy (not including counterclaims), the statute requires that a claimant must first provide a written notice of intent to initiate litigation at least ten (10) business days prior to filing suit. The section requires that the notice state “with specificity” the following:

- That the notice is being provided pursuant to Fla. Stat. § 627.70152;

- The alleged acts or omissions of the insurer giving rise to the suit, which may include a denial of coverage;

- If provided by an attorney or other representative, that a copy of the notice was provided to the claimant;

- If the notice is provided following a denial of coverage, an estimate of damages, if known;

- If the notice is provided following acts or omissions by the insurer other than denial of coverage, the insured must provide (a) the presuit settlement demand, which must itemize the damages, attorney fees, and costs; and (b) the disputed amount.

An insured must file the Notice of Intent to Initiate Litigation via the online filing system. Any information submitted as part of a Notice is a public record and will be displayed on the Florida Department of Financial Services website for public review.

An insurer must respond in writing within ten (10) business days after receiving the notice.

- If the notice is following a denial of coverage by the insurer, the insurer must: (1) Accept coverage; (2) Continue to deny coverage; or (3) Reinspect the damaged property. If the insurer responds by requesting to reinspect the property, it has 14 business days after the response to reinspect the property and accept or continue to deny coverage.

- If the notice is following an allegation of an act or omission by the insurer other than a denial of coverage, the insurer must: (1) Make a settlement offer; or (2) Require the claimant to participate in appraisal or another method of alternative dispute resolution.

If an insured files suit without filing the notice of intent to initiate litigation, or if the insured files suit before the 10-day window for the insurer to respond or the 14-day window for the insurer to reinspect the property, the lawsuit must be dismissed without prejudice.

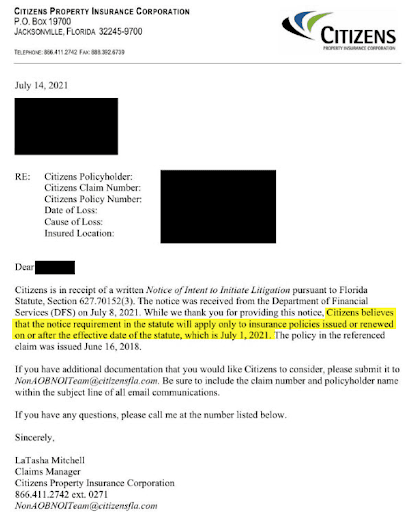

There has been much dispute as to when insureds should start filing the notice based upon the new law. Citizens Property Insurance Corporation has taken the position that § 627.70152 will apply only to insurance policies issued or renewed on or after the effective date of the statute (July 1, 2021). Other carriers have taken a different view of the law.

Florida’s new notice of intent to initiate litigation on property insurance claims will not reduce litigation or remove attorneys from the claims process. Instead, the new law will require attorneys to be involved in more aspects of the property insurance claims process to make sure policyholders’ rights are protected and statutory requirements are met.

This new law harms residential and commercial policyholders when their claims are delayed, denied, or underpaid.

If your insurance company denied your claim, undervalued your damages, or is delaying paying your claim, contact us for a Free Consultation and Free Review of your Claim.

The information included here will give you a basic understanding of how the claim process should go and the legal rights that give you leverage to get a fair outcome. Here are the places where your rights as an insurance consumer are spelled out:

Florida Statutes – Chapters 624 to 651 INSURANCE

Unfair Insurance Trade Practices – §§ 626.951 to 626.99 Fla. Stat.

Florida Administrative Code (F.A.C.) –Title 69, Subtitles 69O and 69B, Insurance Regulation and Insurance Agent/Agency Services.

Notices and bulletins issued by the Florida Office of Insurance Regulation